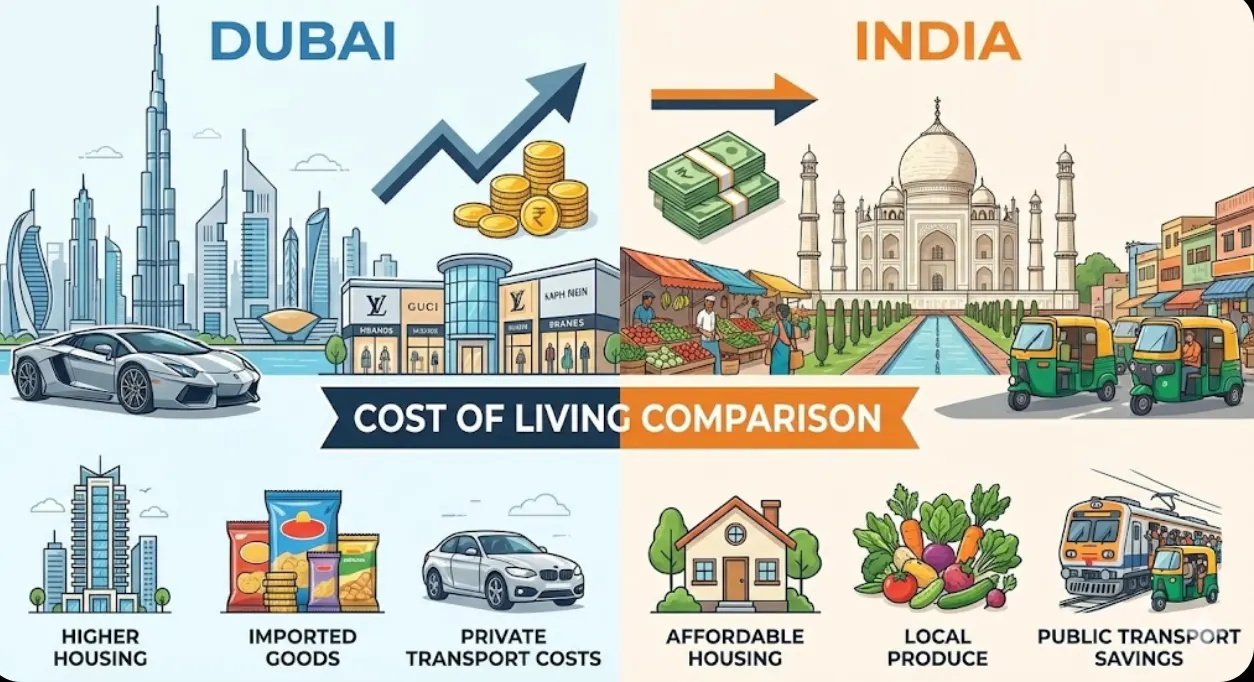

About the Cost of Living – Dubai vs India

The cost of living in Dubai vs India is significantly higher in Dubai, but strong salaries and tax benefits can balance expenses for many professionals. If you are looking for any property in Dubai then Lykans realty is the best real estate company in Dubai.

Housing and Rent: A Major Expense in Both Locations

Housing is the biggest driver of the average cost of living in Dubai vs India for both singles and families. Thinking of Buying a Second Home in Dubai? Find out everything you need to know about the best locations and investment opportunities.

| Aspect / Insight | Dubai (UAE) | India |

| 1 BHK city centre rent | Around ₹1.4–₹1.5 lakh per month, depending on area. | Around ₹15,000–₹25,000 per month in major cities. |

| Relative rent level | Rent can be about 8–10 times higher than India on average. | Much lower, though metros like Mumbai and Delhi remain pricey. |

| Buying property per sq. m. | Often more than three times costlier than Indian metros. | Considerably cheaper per sq. m. in many cities. |

| Impact on cost of living in Dubai vs India | Housing is the single biggest expense for expats. | Lower housing keeps overall cost of living in India vs Dubai much cheaper. |

| For long‑term investors | Many compare communities before they buy a second home in Dubai. (buy second home Dubai link) | Buyers in India often focus on city growth and infrastructure. |

Groceries and Food: How Much Do You Spend on Food?

Daily groceries and eating out form a major part of Dubai vs India living costs, especially for families and food lovers. Experience the charm of Living in Al Mahra, Arabian Ranches, a serene and luxurious community perfect for families

| Aspect / Insight | Dubai | India |

| Overall groceries level | Around 2–2.5 times more expensive than India overall. | Staples and fresh produce are relatively affordable. |

| Meal at inexpensive restaurant | Roughly three times costlier than in India. | Much cheaper in local restaurants and dhabas. |

| Cost of living in Dubai for Indian family | Eating out frequently pushes Dubai vs India monthly expenses up quickly. | Families can maintain lower food budgets with home‑cooked meals. |

| cost of living in dubai for indian | Needs careful planning of eating out and grocery choices. | More flexibility in food spending patterns. |

| Access to familiar Asian groceries | Asian supermarkets in Dubai help control food costs for Indians. (Asian supermarkets Dubai link) | India naturally offers Indian staples at low prices. |

Transportation Costs: Getting Around Dubai and India

Transport is cheaper in India overall, but Dubai offers modern metro, buses and taxis with higher comfort and reliability. Discover the stunning Mirador homes in Arabian Ranches, where luxury meets tranquility in the heart of Dubai.

| Aspect / Insight | Dubai (UAE) | India |

| Monthly public transport pass | Often 5–6 times higher cost than India. | Much cheaper monthly passes in most cities. |

| Taxi and local ride fares | Around 3–4 times higher than in India. | Lower fares, but traffic and comfort vary. |

| Fuel prices | Generally lower per litre, easing car‑ownership costs. | Higher fuel cost compared to UAE. |

| Effect on cost of living comparison Dubai vs India | Higher fares lift Dubai vs India transportation cost. | Cheaper transport helps keep cost of living in India vs Dubai down. |

| Role in cost of living in dubai in inr per month | Smart use of metro and shared taxis keeps costs manageable for expats. | Public transport and two‑wheelers reduce monthly travel budgets. |

Healthcare: Medical Expenses in Dubai vs India

Healthcare is a vital part of the real cost of living Dubai vs India, especially for families with children or seniors. Enjoy Dubai’s best Sunset Hotspots for unforgettable views and a perfect end to your day.

| Aspect / Insight | Dubai (UAE) | India |

| Basic doctor visit cost | Around 3–4 times higher than India. | More affordable private consultations. |

| Medicines and basic healthcare | Several times costlier than India. | Wider range of price points, generally cheaper. |

| Insurance and employer benefits | Health insurance is crucial; often employer‑provided. | Insurance less universal, but treatment still cheaper. |

| Role in cost of living in dubai vs india | High medical and insurance costs increase Dubai vs India living costs. | Lower healthcare costs help offset lower salary in Dubai vs India comparison. |

| Medical tourism and treatment options | High‑quality facilities, but expensive without coverage. | India attracts medical tourists due to cost advantage. |

Salaries and Income Comparison: How Much Do You Earn in Dubai vs India?

When you compare salary in Dubai vs India, average net income in UAE is many times higher than Indian averages. Looking for the Best Outdoor Cafes in Dubai? Explore the top spots to relax and enjoy the perfect cup of coffee here.

| Aspect / Insight | Dubai (UAE) | India |

| Average monthly net salary | Around $3,410 (about ₹2.8 lakh). | Around $334 (about ₹27,000). |

| salary in dubai vs india ratio | Salary can be more than six times higher in Dubai. | Lower salaries relative to UAE, even in metros. |

| Months of living covered by salary | Salary covers about 1.6 months of UAE costs. | Salary covers less than a full month of Indian costs on average. |

| Dubai vs India savings potential | Strong if housing and insurance are part of package. | Savings depend on low fixed costs and family support. |

| Role in cost of living in dubai and india | High salary plus no tax drives Dubai vs India salary vs living cost advantage. | Lower income but cheaper lifestyle shapes cost of living in India and Dubai comparisons. |

Schooling: Dubai vs India

Education costs can transform the cost of living in Dubai for Indian family, especially with international schools. Living in Hor Al Anz offers a quiet and convenient lifestyle in a well-established neighborhood.

| Aspect / Insight | Dubai (UAE) | India |

| Preschool monthly fees | Often around nine times higher than India. | Far lower, especially in non‑premium private schools. |

| International primary school annual fees | Roughly $11,600 per year on average. | Roughly $2,000 per year for comparable tier. |

| Dubai vs India education expenses | Major driver of cost of living in dubai for indian family. | More affordable schooling eases budgets. |

| Impact on average cost of living in dubai vs india | Raises Dubai vs India living costs sharply if choosing top international schools. | Keeps cost of living comparison india vs dubai favourable for many families. |

| Long‑term family planning | Families weigh education quality against cost of living in dubai vs india in rupees. | Many prefer India for lower education cost and extended family support. |

Taxes: Dubai’s Tax-Free Advantage vs India’s Tax System

One major advantage in the cost of living index Dubai vs India is Dubai’s tax‑free personal income environment. Explore the best Dubai Communities for British Expats, offering a blend of culture, convenience, and comfort.

| Aspect / Insight | Dubai (UAE) | India |

| Personal income tax | Generally 0% on individual salaries. | Progressive income tax slabs apply to earnings. |

| Take‑home share of salary | Very high; most of your salary is net income. | Lower, as tax and surcharges reduce net pay. |

| Role in salary in dubai vs india | Enhances Dubai vs India salary vs living cost advantage significantly. | Requires closer budgeting to build savings. |

| Effect on cost of living in dubai vs india | Higher gross plus no tax boosts remittance and savings potential. | Even with lower costs, tax cuts into disposable income. |

| Decision factor | Central when deciding dubai vs india which is better for long‑term wealth. | Important in planning investments and savings in India. |

Quality of Life: Which City Offers a Better Standard of Living?

Quality of life combines income, safety, healthcare, infrastructure and leisure, not just cost of living in Dubai vs India in rupees. Dive into an unforgettable experience at Dolphin Bay Aquaventure, where fun and adventure meet.

| Aspect / Insight | Dubai (UAE) | India |

| Quality of life and safety | Higher quality and safety scores on many indices. | Lower scores, but strong culture and family bonds. |

| Overall monthly living expenses | Much higher Dubai vs India living costs. | Lower monthly cost base in most cities. |

| Dubai vs India lifestyle cost | High, but includes beaches, malls, cafes and leisure. | Lower, with vibrant local markets and social life. |

| Leisure and experiences | Best outdoor cafes, board game cafes, sunset hotspots and attractions. (lykansrealty Dubai leisure links) | Wide range of low‑cost cultural and local experiences. |

| Community and housing choice in Dubai | Areas like Dubai Marina vs Downtown Dubai or JVT vs JVC change lifestyle and rent (relevant interlink articles). | In India, choice is more about city, locality and proximity to family. |

What is the Cost of Living in Dubai in INR per Month?

For most Indians, the cost of living in Dubai in INR per month ranges roughly from ₹90,000–₹1.3 lakh for a shared setup and up to ₹2–₹4 lakh for a more comfortable lifestyle, depending on rent, family size and city area. Looking for Studios for Rent in Dubai Silicon Oasis? Find affordable and convenient options in this growing hub.

Cost of Living Index Dubai vs India and Overall Comparison

Looking at the cost of living index India vs Dubai helps quantify average living cost Dubai versus India clearly.

| Aspect / Insight | India (typical) | UAE / Dubai (typical) |

| Cost of living – single person | About $424 per month. | About $2,101 per month. |

| Cost of living – family | About $1,001 per month. | About $4,583 per month. |

| One person rent | ≈ $170 per month. | ≈ $1,412 per month. |

| Food expenses | ≈ $166 per month. | ≈ $419 per month. |

| Transport expenses | ≈ $45 per month. | ≈ $132 per month. |

| cost of living comparison dubai vs india | UAE is roughly 3–5 times higher overall. | Confirms India’s clear cost advantage. |

Cost of Living in Dubai Compared to India for Different Profiles

Different life stages feel Dubai vs India expense comparison very differently. Living in Mira, Dubai offers a blend of modern amenities and suburban tranquility. Discover the best homes.

| Profile / Insight | Dubai (UAE) | India |

| Single professional | High rent, high income, good savings if lifestyle is controlled. | Lower costs but lower pay; savings moderate. |

| cost of living in dubai for indian family | High rent and school fees, strong lifestyle and amenities. | Much lower housing and education costs. |

| cost of living in dubai for indian students | Higher rent, tuition and visas; needs careful budgeting. | Lower living and education costs in most student cities. |

| cost of living in india vs dubai decision | Many move for tax‑free salary and career growth. | Others stay for affordability and family support. |

| Dubai vs India living cost breakdown usage | Helps assess Dubai vs India which is better for a specific life stage. | Clarifies when staying in India is financially smarter. |

Dubai vs Indian Rupee: Currency Impact on Living Costs

The Dubai vs Indian rupee exchange rate is central to cost of living in dubai vs india in rupees and your savings power.

| Aspect / Insight | Dubai (UAE) | India |

| Cost base vs salary | High costs but very high salaries. | Low costs with lower salaries. |

| Local purchasing power | Higher purchasing power index. | Lower purchasing power index. |

| Effect on remittances | Earnings in AED convert favourably to INR. | Earnings in INR are weaker when converted to AED. |

| Role in cost of living comparison india vs dubai | Exchange rate defines Dubai vs India savings potential. | Also shapes investments and relocation choices. |

| Link with Dubai property and jobs | Many weigh currency and salaries before they invest in off‑plan Dubai or search jobs (off‑plan and best time to find job Dubai links). | Job and investment decisions also depend on INR stability. |

Is Dubai More Expensive Than India or Is Dubai Cheaper Than India?

Dubai is clearly more expensive than India, with overall living expenses, housing, food and transport in Dubai costing several times more than India, so Dubai is not cheaper than India for most everyday living needs. Looking for the perfect Vacation Home Rentals in Dubai? Explore top rental options for a luxurious getaway.

Final Thoughts About cost of living: dubai vs india

Dubai offers higher costs and higher rewards, while India offers affordability and familiarity; the better choice depends on your career stage, family needs and savings goals.

FAQ’s related to cost of living: dubai vs india

Q1. Is Dubai more expensive than India for everyday living?

Yes, cost of living in Dubai compared to India is several times higher for housing, schooling and eating out.

Q2. What is the cost of living in Dubai in INR per month for a single person?

The cost of living in Dubai in per month for a single person is about ₹90,000–₹2 lakh, depending on lifestyle.

Q3. Is dubai vs india which is better for savings?

If salary in Dubai vs India is much higher and tax‑free, Dubai can deliver better long‑term savings than India.

Q4. How does cost of living in dubai vs india in rupees affect families?

Families face higher rent and school fees; monthly costs often reach ₹2.5–₹4 lakh in Dubai.

Q5. Is cost of living in india vs dubai better for students and freshers?

Students and freshers usually find India cheaper; Dubai works when pay and prospects justify higher Dubai vs India living costs.

About The Author