According to the research team of Lykan’s Realty, Jumeirah Lake Towers Dubai stands as one of the city’s most dynamic and investment-worthy neighborhoods in 2026.

This comprehensive guide explores everything you need to know about JLT Dubai, from its stunning lakeside apartments to its thriving business district.

Overview: Understanding Jumeirah Lakes Towers

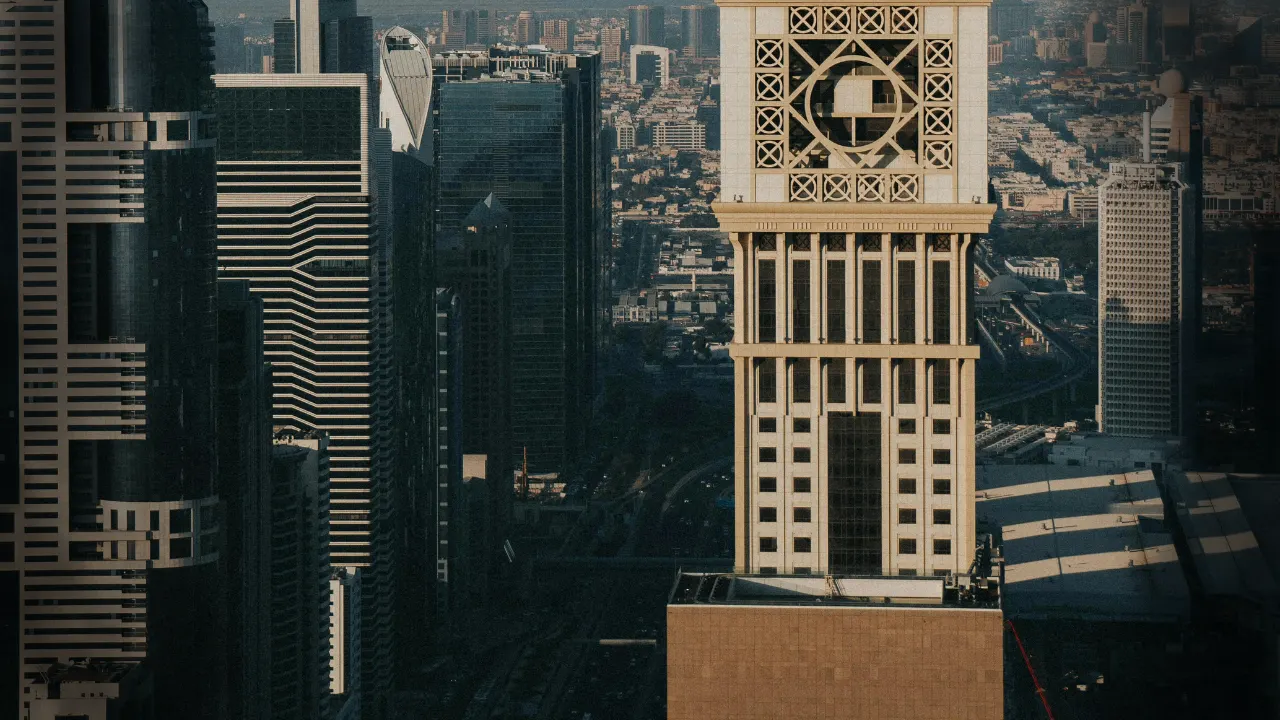

Jumeirah Lake Towers or JLT, Dubai, is a coherently developed mixed-use project and home to 80 high-rise towers conveniently located along three lakes. This waterfront district of JLT has by now metamorphosed into a self-sustained hub offering residential, commercial, and lifestyle facilities.

Covering a colossal area, it has 730,000 square meters of lakes, waterways, and flora. According to the real estate pundits at Lykan’s Realty, residential towers in JLT range between 35 and 45 floors; Almas Tower, on the other hand, stands out at 68 stories and is truly a landmark amongst the towers of JLT.

JLT Dubai Metro area belongings can benefit from the connectedness of the two stations, namely Jumeirah Lakes Towers and DMCC, providing ease of access to the major business districts, shopping destinations, and Dubai International airport. With over 24,000 companies housed within the DMCC Free Zone in the business district of Jumeirah Lake Towers, JLT is increasingly becoming home to a global commercial hub.

What Makes Jumeirah Lake Towers Dubai Unique?

1.Strategic Location and Connectivity

The JLT urban neighborhood enjoys unparalleled accessibility in Dubai’s real estate landscape. Positioned near Dubai Marina, Emirates Hills, and Al Sufouh, Jumeirah Lakes Towers offers residents and businesses exceptional connectivity.

Lykan’s Realty experts highlight that the JLT Dubai Metro connected area provides residents with trains arriving every 4 to 7 minutes during peak hours, connecting seamlessly to Burj Khalifa, Dubai Mall, and Dubai International Airport. The Dubai Tram connection at nearby DAMAC Properties station extends access to Jumeirah Beach Residence and Dubai Marina waterfront.

2.Cluster Organization: The Heart of JLT Community

The clusters of Jumeirah Lake Towers are organized in alphabetical order from A to Z, with each cluster comprising three towers (some clusters may consist of more than three towers), with ample dedicated parking structures and waterfront retail spaces. This ingeniously creates distinct micro-communities within the larger JLT community, securing neighborhood identity but articulated as one coherent urban entity.

Per the real estate professionals in Lykan´s Realty, every cluster displays a distinctive architectural design, unit configuration, etc. thus aggregating different options for buyers and investors seeking Jumeirah Lake Towers apartments.

Is JLT Dubai the Best Place to Buy Property in Dubai?

Understanding Dubai Real Estate Market 2026

The Dubai real estate market 2026 presents compelling opportunities for both end-users and investors. According to market forecasts, prime residential areas like JLT are expected to demonstrate resilience despite projected delivery of 99,686 apartment units and 15,284 villas across Dubai.

Lykan’s Realty market researchers observe that JLT Dubai real estate investment offers particular advantages due to its established infrastructure, mature community amenities, and limited future supply within the existing development.

While some mid-market areas may experience price adjustments, Jumeirah Lake Towers lifestyle communities with robust amenities and strategic locations are positioned to maintain value.

Which is the Best Place to Buy Property in Dubai?

When evaluating which is the best place to buy property in Dubai, investors must consider multiple factors including rental yields, capital appreciation potential, community maturity, and lifestyle amenities.

JLT consistently ranks among top investment neighborhoods in Dubai due to its balanced offering.Best property projects in Dubai for foreign investors increasingly include JLT developments due to freehold ownership rights, established infrastructure, and proximity to business hubs.

The JLT family-friendly community aspect particularly appeals to expatriate families seeking quality schools, parks, and recreational facilities nearby.

Rental Yields and Returns on Investment

JLT Dubai real estate investment delivers compelling rental yields averaging 6-8%, with some units achieving up to 7.6%. According to Lykan’s Realty investment analysts, these figures significantly outperform many established communities including Downtown Dubai and Dubai Marina, where yields typically hover around 4-5%.

The Dubai real estate ROI guide for JLT indicates:

- Studio apartments: 7.22% average rental yield

- One-bedroom units: 6-7% average rental yield

- Two-bedroom apartments: 6-7% average rental yield

- Short-term rentals: 7.5-9% potential ROI in licensed buildings

Capital Appreciation Prospects

Lykan’s Realty forecasts JLT high-rise towers will experience 12-15% value appreciation by 2030, driven by infrastructure enhancements, proximity to emerging developments like Dubai Harbour, and limited new residential supply within the established community.

Off-plan vs ready property considerations in JLT favor ready properties for immediate rental income, while select off-plan projects from reputable developers like Danube Properties (Diamondz tower) and MAG Group (MBL Signature) offer capital appreciation potential of 10% post-handover.

How to Buy Property in JLT: Step-by-Step Guide

Dubai Property Ownership Laws for Foreigners

Dubai property ownership laws for foreigners permit full freehold ownership in designated areas, including Jumeirah Lake Towers. International buyers enjoy identical rights to UAE nationals within freehold zones, including the ability to sell, rent, mortgage, gift, or bequeath properties.

According to Lykan’s Realty legal experts, expat real estate investment in Dubai requires minimal documentation:

- Valid passport

- Emirates ID (for residents)

- Proof of funds or mortgage pre-approval

- Signed Sales and Purchase Agreement

How to Buy Property in Dubai Step by Step

Step 1: Research and Property Selection

Conduct thorough market research using platforms like Property Finder and Bayut to identify suitable Jumeirah Lake Towers apartments matching your budget and requirements. First-time homebuyers in Dubai candidates should explore the Dubai Land Department’s First Time Home Buyer Programme, offering 100% refund on the 4% DLD registration fee for eligible buyers.

Step 2: Secure Financing

Getting mortgage financing approved in Dubai requires pre-approval from participating banks. For expat real estate investment in Dubai, loan-to-value ratios typically reach 75% for residents and 50-70% for non-residents.

Major banks offering mortgage financing Dubai foreigners include:

- Emirates NBD

- Mashreq Bank

- Dubai Islamic Bank

- HSBC UAE

- ADCB

International buyers should expect 30-40% down payment requirements, with mortgage rates ranging from 3.8% to 6.2% annually depending on loan terms and borrower profiles.

Step 3: Sign Memorandum of Understanding

Once you’ve selected a property, negotiate terms and sign a Sale and Purchase Agreement (Form F), outlining transaction details. Pay a 10% deposit to secure the property, formalized at a Registration Trustee’s office.

Step 4: Obtain No Objection Certificate

The seller must secure an NOC from the property developer, confirming no outstanding service fees or charges. This document is essential for property registration Dubai and typically involves a nominal fee.

Step 5: Complete Dubai Land Department Registration

Property registration Dubai finalizes at a DLD trustee office or via the Dubai REST app. Required fees include:

- 4% transfer fee (typically split between buyer and seller)

- AED 4,000 registration fee for properties over AED 500,000

- 0.25% mortgage registration fee (if applicable)

Upon completion, you receive an official Title Deed, establishing legal ownership recognized for resale, leasing, or financing.

How to Choose Real Estate Agent Dubai

How to choose real estate agent Dubai significantly impacts your transaction success. Lykan’s Realty advisors recommend verifying:

- Valid RERA license and registration

- Specialization in JLT or target community

- Minimum 5 years experience

- Positive client testimonials and reviews

- Transparent commission structure

RERA-certified agents provide market insights, negotiation expertise, and ensure compliance with Dubai real estate legal guide requirements.

How to Negotiate Dubai Property Price

How to negotiate Dubai property price effectively requires market knowledge, timing, and strategic approaches. According to Lykan’s Realty negotiation specialists, successful tactics include:

- Conduct Comparative Market Analysis: Research comparable properties in similar JLT clusters to establish fair market value

- Assess Seller Motivation: Properties listed longer than 60 days offer greater negotiation flexibility

- Make Data-Backed Offers: Present RERA Rental Index data and recent transaction records

- Negotiate Beyond Price: Consider payment terms, furnishings, maintenance responsibility, and closing timeline

- Time Your Offer: Summer months (April-August) typically provide 20-30% more leverage than peak season

Common mistakes buying property in Dubai include emotional decision-making, skipping due diligence, and making unrealistic offers. Lykan’s Realty experts emphasize approaching negotiations professionally with realistic expectations based on market data.

Living in Jumeirah Lake Towers: Lifestyle and Amenities

1.JLT Residential Towers: Housing Options

JLT residential towers offer diverse accommodation options from studios to four-bedroom apartments, with average rental prices reflecting the community’s competitive positioning:

- Studio apartments: AED 60,000-62,460 annually

- One-bedroom units: AED 85,000-90,191 annually

- Two-bedroom apartments: AED 134,169-160,000 annually

- Three-bedroom residences: AED 204,990 annually

According to Lykan’s Realty property managers, purchase prices for Jumeirah Lake Towers apartments range from AED 1 million to AED 1.5 million for one-bedroom units, with average price per square foot approximately AED 1,292.

2.JLT Family-Friendly Community Features

The JLT family-friendly community provides comprehensive amenities catering to residents of all ages:

Educational Facilities: While no primary or secondary schools operate within JLT itself, numerous quality institutions are located within 10-15 minutes:

- Emirates International School (Meadows) – 14 minutes

- Dubai British School (Emirates Hills) – 11 minutes

- American School of Dubai – 23 minutes

- Kings’ School Al Barsha – 15 minutes

JLT Clusters host several nurseries including Mosaic Nursery, Rainbow Valley Nursery, Paddington Nursery, and Dewdrops Nursery, providing early childhood education options.

3.Recreation and Green Spaces

JLT waterfront living emphasizes outdoor lifestyle with extensive facilities:

JLT Park serves as the community’s recreational hub, featuring:

- Well-maintained jogging and cycling tracks

- Basketball and football courts

- Children’s playgrounds with modern equipment

- Exercise stations and fitness areas

- Picnic spots and barbecue facilities

- Tennis courts

The park operates daily from early morning to late evening, accommodating various schedules and providing 24-hour security with CCTV coverage.

Lakeside promenades encircling the three lakes offer scenic walking paths, outdoor dining options, and community gathering spaces, creating the distinctive JLT waterfront living experience.

4.Dining and Entertainment

Jumeirah Lake Towers lifestyle includes diverse culinary options ranging from casual cafes to upscale restaurants:

Popular dining destinations include:

- Café Isan (authentic Thai cuisine)

- Mythos Kouzina & Grill (Greek specialties)

- Friends Avenue (modern café with breakfast and lunch)

- Pitfire Pizza (artisanal pizzas)

- Daikan (Japanese ramen)

- Maiz Tacos (Mexican cuisine)

- Streetery (multi-cuisine food hall)

Most restaurants feature lakeside terraces, providing dining experiences with scenic water views characteristic of JLT lakeside apartments.

JLT Business Hub Dubai: Commercial Opportunities

1.DMCC Free Zone Excellence

The JLT business hub Dubai centers around the Dubai Multi Commodities Centre (DMCC), recognized as the world’s leading free zone for nine consecutive years. JLT commercial office spaces within DMCC offer international businesses:

- 100% foreign ownership

- 0% corporate and personal tax

- 100% capital repatriation

- Flexible licensing for over 600 business activities

- Access to 24,000+ established companies

Lykan’s Realty commercial division notes that JLT commercial center Dubai provides diverse office solutions from virtual desks and flexi spaces to full-floor headquarters, accommodating startups through multinational corporations.

2.Almas Tower: The Crown Jewel

Almas Tower, the 68-story centerpiece of Jumeirah Lake Towers business district, houses the Dubai Diamond Exchange, Dubai Pearl Exchange, and DMCC headquarters. This architectural icon serves as the global trading hub for diamonds, colored gemstones, and pearls, featuring high-security facilities including diamond vaults and grading laboratories.

JLT commercial office spaces in Almas Tower command premium positioning within the JLT mixed-use development, attracting commodity traders, financial services firms, and international businesses.

Is It a Good Time to Buy Property in Dubai?

Analyzing Market Conditions for 2026

Is it a good time to buy property in Dubai? According to Lykan’s Realty market analysis, 2026 presents strategic opportunities for informed buyers, particularly in established communities like JLT.

Market indicators supporting investment include:

- Projected 10% price growth through end-2025

- Prime residential areas expected to rise 4-6% in H2 2025-2026

- Strong population growth trajectory toward 5 million by 2030

- Continued HNWI migration with 9,800 millionaires relocating to UAE in 2025

- Zero property, income, and capital gains taxes

- Golden Visa program driving investment flows

Lykan’s Realty economists project that while overall supply increases may create pricing flexibility in some segments, Jumeirah Lake Towers Dubai benefits from limited future development within the existing footprint, supporting value stability.

Off-Plan vs Ready Property Considerations

Off-plan vs ready property decisions require careful evaluation of individual circumstances and objectives:

Ready Property Advantages:

- Immediate occupancy or rental income

- Complete visibility of unit condition and views

- Established community amenities

- Lower financing risk

- No construction delays

Off-Plan Property Advantages:

- Lower entry prices (10-20% below ready units)

- Flexible payment plans

- Higher capital appreciation potential

- Modern designs and smart home features

- Customization options

Lykan’s Realty recommends first-time homebuyers in Dubai candidates prioritize ready properties for certainty, while experienced investors may consider off-plan opportunities from proven developers like Emaar, Damac, and Sobha Realty.

Common Mistakes Buying Property in Dubai

1.Critical Errors to Avoid

Common mistakes buying property in Dubai can significantly impact investment returns. According to Lykan’s Realty risk assessment team, frequent pitfalls include:

- Insufficient Location Research: Buying without analyzing connectivity, infrastructure development, and rental demand patterns

- Ignoring Rental Yield Calculations: Focusing solely on purchase price while neglecting realistic rental income projections

- Poor Developer Selection: Choosing projects based on marketing hype rather than developer track records

- Overlooking Service Charges: Failing to account for annual maintenance fees that impact net returns

- Skipping Legal Due Diligence: Not verifying property registration, NOC status, and developer compliance

- Mortgage Pre-Approval Neglect: Booking properties before securing confirmed financing

- Emotional Decision-Making: Purchasing based on aesthetics rather than investment fundamentals

- Inadequate Exit Strategy: Not considering resale liquidity and market cycles

Lykan’s Realty advisory services emphasize thorough due diligence, financial planning, and professional guidance to mitigate these risks and optimize Dubai real estate market 2026 opportunities.

Top Investment Neighborhoods in Dubai Beyond JLT

1.Al Furjan Investment Area

Al Furjan investment area offers affordable villas and townhouses with strong family appeal. Located near key business corridors with Metro connectivity, this master-planned community provides investors with rental yields averaging 6-8% and significant appreciation potential driven by ongoing infrastructure development.

2.Dubai Hills Estate Investment Guide

Dubai Hills Estate investment guide consistently highlights this 11-million-square-meter development as a premier luxury option. Positioned between Downtown Dubai and Dubai Marina, Dubai Hills Estate features:

- Golf-course views and extensive green spaces

- Premium schools and healthcare facilities

- Average ROI of 6.9%

- Strong capital appreciation trajectory

According to Lykan’s Realty luxury property specialists, Dubai Hills Estate investment guide recommendations emphasize villas near the golf course and modern apartments close to Dubai Hills Mall for optimal returns.

3.Dubai Production City Media Hub

Dubai Production City media hub serves creative industries, production companies, and media businesses seeking cost-effective facilities with free zone benefits. While primarily commercial, mixed-use developments in this emerging area offer long-term appreciation potential for forward-looking investors.

Practical Tips from Lykan’s Realty Experts

Expert Tip 1: Timing Your JLT Investment

Lykan’s Realty market timing specialists recommend purchasing Jumeirah Lake Towers apartments during off-peak months (April-August) when inventory levels increase and seller motivation strengthens. Historically, summer transactions in JLT yield 5-8% better negotiation outcomes compared to peak season.

Expert Tip 2: Cluster Selection Strategy

Within Jumeirah Lake Towers clusters, proximity to Metro stations significantly impacts rental demand and resale liquidity. Clusters A, B, D, E, and H offer superior connectivity, commanding 8-12% rental premiums according to Lykan’s Realty rental analytics.

Expert Tip 3: Service Charge Evaluation

Evaluate annual service charges carefully, as these vary substantially across JLT residential towers. Buildings with comprehensive amenities like pools, gyms, and 24-hour security typically charge AED 8-15 per square foot annually.

Lykan’s Realty property management recommends calculating net yield after service charges to accurately assess investment performance.

Expert Opinions on JLT Investment

- Property Analyst, Lykan’s Realty: “JLT represents one of Dubai’s most balanced investment propositions in 2026. The combination of established infrastructure, DMCC business presence, and competitive pricing creates sustained rental demand. We project JLT to outperform many emerging communities due to its maturity and limited future supply.”

- Senior Investment Advisor, Lykan’s Realty: “For expat real estate investment in Dubai, JLT offers exceptional value compared to Dubai Marina or Downtown. The 6-8% rental yields, coupled with lower entry prices, generate superior cash-on-cash returns. International buyers particularly appreciate the walkability, Metro access, and self-contained community features.”

- Portfolio Manager, Lykan’s Realty: “When evaluating off-plan vs ready property options in JLT, we generally recommend ready units for immediate cash flow. The new Diamondz and Marriott Residences projects merit consideration for long-term holders willing to wait for completion, but established towers provide greater certainty and immediate rental income.”

Why This Guide Benefits Property Seekers

According to Lykan’s Realty research and expert team, this comprehensive guide serves multiple stakeholder needs:

- First-Time Buyers: The detailed explanation of how to buy property in Dubai step by step, including property registration Dubai processes and getting mortgage financing approved in Dubai, provides an actionable roadmap for newcomers navigating the market.

- Investment-Focused Buyers: In-depth analysis of JLT Dubai real estate investment returns, Dubai real estate ROI guide metrics, and comparison with other top investment neighborhoods in Dubai enables data-driven decision-making.

- Lifestyle Seekers: Exploration of Jumeirah Lake Towers lifestyle amenities, JLT family-friendly community features, and JLT waterfront living experiences helps families and individuals assess community fit.

- International Investors: Clarification of Dubai property ownership laws for foreigners, expat real estate investment in Dubai processes, and mortgage financing Dubai foreigners options removes barriers for overseas buyers.

Lykan’s Realty advisory team ensures this guide reflects current market conditions, regulatory frameworks, and practical insights drawn from thousands of successful transactions in Jumeirah Lakes Towers and across Dubai.

Property Investment Comparison: JLT vs Other Areas

| Community | Average Rental Yield | Studio Rent (Annual) | 1BR Purchase Price | Metro Access | Community Maturity |

| Jumeirah Lake Towers | 6-8% | AED 60,000-62,460 | AED 1M-1.5M | 2 stations | Established |

| Dubai Marina | 4-5% | AED 75,000-85,000 | AED 1.5M-2M | 1 station | Established |

| Business Bay | 7-9% | AED 55,000-70,000 | AED 900K-1.3M | 1 station | Established |

| JVC | 7-8% | AED 45,000-55,000 | AED 700K-950K | Bus only | Developing |

| Dubai Hills Estate | 6.9% | AED 70,000-85,000 | AED 1.3M-1.8M | Planned | Developing |

Table compiled by Lykan’s Realty research division using Q4 2025 data

JLT Cluster Analysis: Investment Hotspots

| Cluster | Notable Towers | Key Features | Investment Grade |

| Cluster A | New Dubai Gate, Lake Elucio | Near Metro, affordable pricing | A |

| Cluster D | Lake Terrace, Lake City Tower | Central location, lake views | A+ |

| Cluster H | Concorde Tower | Competitive rents, high demand | A |

| Cluster M | Icon Tower 1 | Premium positioning | A |

| Cluster Q | Saba Tower 3, MAG 214 | Established amenities | A |

| Cluster X | Jumeirah Bay X1 | Strong ROI potential | A |

Grading based on Lykan’s Realty proprietary analysis of rental yields, occupancy rates, and capital appreciation

Conclusion: JLT’s Enduring Appeal

According to Lykan’s Realty, Jumeirah Lake Towers (JLT) Dubai is a prime example of successful urban planning, combining residential comfort, commercial vitality, and lifestyle amenities within a master-planned community. With established infrastructure, competitive pricing, strong rental yields, Metro access, and the DMCC business hub, JLT waterfront living continues to attract end-users, investors, and global corporations.

Looking ahead, 2026 presents strategic opportunities to buy property in Dubai, with JLT well-positioned for capital stability and modest appreciation due to limited future supply and a balanced residential–commercial mix aligned with the long-term vision of the Dubai Land Department and regulatory frameworks supported by GDRFA Dubai.

Whether exploring JLT lakeside apartments, commercial office spaces, or high-rise investment properties, Lykan’s Realty provides end-to-end advisory support -from price negotiation and property registration in Dubai to post-purchase management helping foreign investors identify the best property projects in Dubai with confidence.

Frequently Asked Questions

1.What is the average price per square foot in JLT?

As of 2026, JLT apartments average around AED 1,290 per sq. ft., making them more affordable than Dubai Marina and Downtown Dubai while offering similar lifestyle amenities.

2.Can foreigners buy property in Jumeirah Lake Towers?

Yes. JLT is a freehold area, allowing foreign nationals full ownership rights, including buying, selling, renting, and inheritance.

3.What rental yields can investors expect in JLT?

Rental yields typically range from 6–8%, with studios achieving higher returns. Licensed short-term rentals can reach up to 9% ROI.

4.How long does property registration take in Dubai?

Property registration usually takes 3–7 business days, especially when completed digitally via the Dubai REST app.

5.What are the main costs when buying property in JLT?

Key costs include 4% DLD transfer fee, registration charges, 2% agency commission + VAT, and mortgage fees if applicable.

6.Is JLT suitable for families with children?

Yes. JLT offers parks, playgrounds, nurseries, pools, and easy access to quality schools within 10–15 minutes.

7.What is the difference between off-plan and ready properties in JLT?

Ready properties offer immediate use and rental income, while off-plan properties provide lower entry prices and flexible payment plans.

About The Author