Mortgage Financing in Dubai

Mortgage financing in Dubai lets buyers purchase property with bank loans up to 80% of value. It’s booming for expats and residents amid real estate growth. Key options include conventional and Sharia-compliant plans. Lykans Realty, the best real estate company, also helps to guide you about the mortgage loans in Dubai.

Types of Mortgage Loans Available in Dubai

Dubai offers diverse mortgage loan Dubai types for various needs. Here’s a quick table of popular ones.

| Type | Description | Best For |

| Conventional Mortgage | Fixed or variable rates, up to 25 years. | Expats seeking flexibility. |

| Islamic Mortgage Finance Dubai | Sharia compliant home finance Dubai, profit-sharing model. | Muslim buyers avoid interest. |

| Gold Mortgage Loan in Dubai | Pledge gold for quick funds on property. | Short-term property needs. |

| Home Purchase Loan Dubai | Covers new or resale homes, up to AED 18M. | First-time buyers in Dubai Marina vs Downtown Dubai. |

Eligibility Criteria for Mortgage Loans in Dubai

What eligibility do you need for mortgage loans in Dubai? Banks check basics like age and income. UAE mortgage financing Dubai supports expats via buy second home Dubai.

| Criteria | Residents/Expats | Non-Residents |

| Age | 21-65 years | 25-70 years |

| Minimum Salary for Home Loan in UAE | AED 10,000 (home loan in UAE with 10,000 salary possible) | AED 15,000 |

| Debt Burden Ratio | Max 50% of income | Max 35% |

Non-residents qualify via mortgage loan for non residents in Dubai with property down payment of 25-50%. Housing finance Dubai grows with demand in best JLT buildings.

Documents Required to Get a Mortgage in Dubai

Gathering docs speeds up mortgage lending Dubai approval. Here’s what top mortgage lenders Dubai need:

- Valid passport and Emirates ID (or visa for expats).

- Last 3-6 months salary certificate and bank statements.

- Property title deed or sales agreement.

- Income proof like trade license for self-employed.

- Mortgage pre approval Dubai form from bank.

For home loan in Dubai for Indian expats, add PAN card and ITR forms. And also Mortgage loan jobs in Dubai? Banks hire advisors—check best time to find job Dubai.

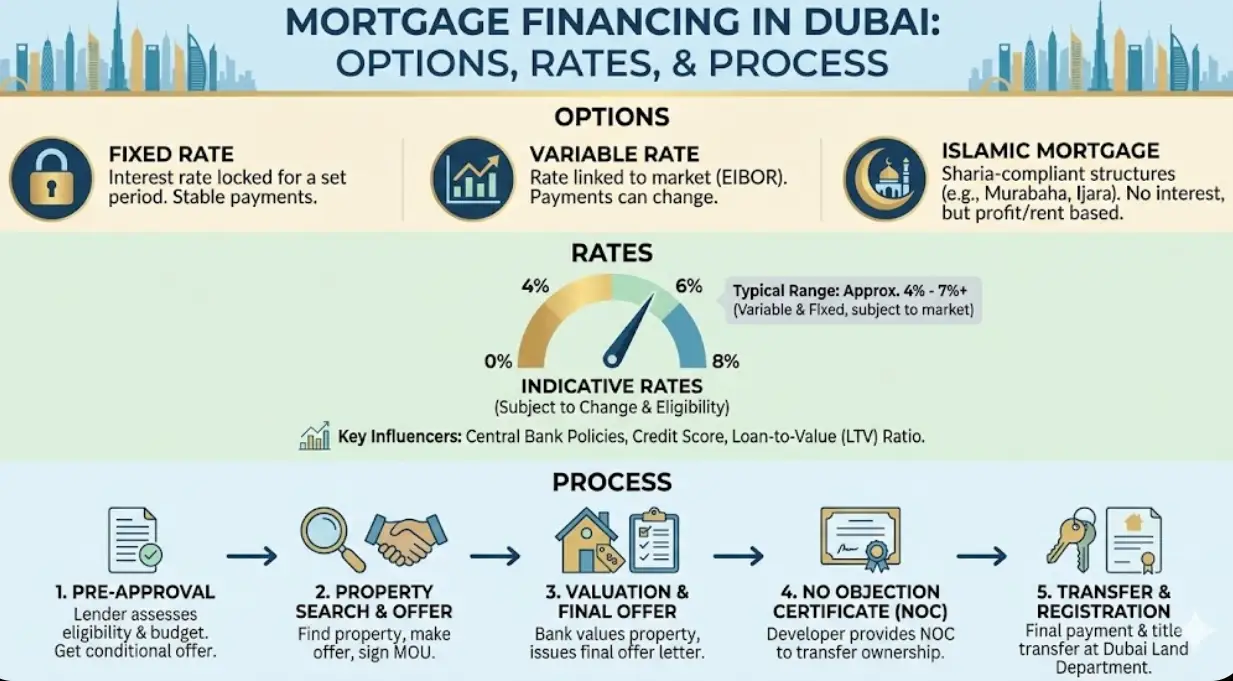

Process to Get a Mortgage in Dubai

How to get a mortgage loan in Dubai? It takes 2-4 weeks. Follow these steps:

- Check eligibility with mortgage loan calculator in Dubai tools.

- Get pre-approval from banks.

- Select property (try off-plan deals via invest in off-plan Dubai).

- Submit docs and valuation.

- Sign offer and register at Dubai Land Department.

- Funds disbursed post-approval.

Use a mortgage broker Dubai for smoother sailing, especially for expat mortgage Dubai.

Top Banks and Financial Institutions Offering Mortgage Loans in Dubai

Which are the best mortgage lenders in Dubai? These banks lead in mortgage financing Dubai.

| Bank | Key Feature | Max Loan |

| Emirates NBD | Competitive rates, quick approval. | AED 18M |

| Mashreq Bank | Sharia options, flexible terms. | AED 20M |

| ADCB | Low fees for expats. | AED 18M |

| Bank of Baroda UAE | Best for Indians (home loan in Dubai for Indian). | AED 10M |

Pros and Cons of Getting a Mortgage in Dubai

Is mortgage financing Dubai worth it? Weigh these quickly.

| Pros | Cons |

| High loan-to-value (up to 80%). | High interest if rates rise. |

| Long terms stabilize payments. | Strict regs for non-residents (mortgage rate in Dubai for non residents). |

| Tax-free ownership boosts ROI. | Fees add 1-2% to costs. |

Ideal for Dubai mortgage for non residents buying in areas like JVT vs JVC.

How does mortgage financing work?

Mortgage financing Dubai works via bank loans covering most property cost. You pay down payment (20-25%), then monthly installments. Home finance in Dubai thrives in family spots like living in Al Mahra Arabian Ranches.

How do banks finance mortgages?

They use deposits and central bank liquidity to fund loans, secured by property.

Banks assess risk via income and property value. This real estate financing Dubai model supports booming markets. Explore Dubai communities for British expats before buying.

How long can you finance a mortgage in Dubai?

Terms stretch to 25 years for residents, 15 for non-residents (home loan in Dubai for non residents). Shorter for seniors. Use home loan calculator UAE to project.

Mortgage Loan Interest Rates and Fees in Dubai

Mortgage loan interest rate in Dubai averages 4-6% now. Fixed or variable. Quick table on mortgage loan rate in Dubai:

| Item | Rate/Fee |

| Interest (Fixed) | 4.5-5.5% |

| Variable | EIBOR + 1.5-2.5% |

| Processing Fee | 0.5-1% of loan |

| Valuation Fee | AED 2,500-5,000 |

Best mortgage rates in Dubai from top banks. Check mortgage loan interest in Dubai trends quarterly. Tools like mortgage loan Dubai calculator help. Living in vibrant spots like living in Mira Dubai makes it worthwhile—pair with home financing Dubai.

Mortgage Loan Repayment Terms and Conditions

What are repayment rules for mortgage loan in Dubai? Key points:

- Monthly payments via direct debit.

- Early settlement fee: 1% in first year.

- Grace period: 3 months post-purchase.

- Refinance home loan Dubai allowed after 1-2 years.

- Insurance mandatory on property.

Sharia compliant home finance Dubai uses profit rates, not interest. Dubai housing loan terms cap at age 65.

What is the best mortgage loan in Dubai?

Best mortgage loan in Dubai depends on profile—quick approvals for expats. For expats, check mortgage loans for expats in Dubai with low debt ratios.

Minimum salary for home loan in UAE?

Minimum salary for home loan in UAE is AED 10,000 for residents. Home loan in UAE with 10,000 salary works for small loans. Non-residents need more.

Home loan interest rate in Dubai explained.

- Home loan interest rate in Dubai ties to EIBOR. Expect 4-7% based on credit. Indians favor banks for home loan in Dubai for Indian rates.

- Use home loan in Dubai calculator for scenarios. Dubai property finance shines for off-plan like Mirador Arabian Ranches.

Mortgage loan calculator in Dubai: how to use.

- The mortgage loan calculator in Dubai estimates payments. Input loan amount, rate (mortgage loan rate in Dubai), term.

- Example: AED 2M at 5% over 20 years = AED 13,200/month.

- Home loan calculator UAE versions factor fees. Great for property mortgage in Dubai planning.

Gold mortgage loan in Dubai options.

Gold mortgage loan in Dubai lets you pledge gold for property funds. Quick approval, lower rates. Ideal bridge financing.

Final Thoughts About Mortgage Financing in Dubai

Mortgage financing Dubai unlocks property dreams with competitive rates and easy expat access. Act now amid market highs. Dubai mortgage finance options include refinance home loan Dubai for better rates. Consult mortgage advisor Dubai. Consult experts for your home loan in Dubai.

FAQ’s Related to Mortgage Financing in Dubai

Q1. How to get mortgage loan in Dubai as a non-resident?

Non-residents need 25-50% down, AED 15K+ salary. Pre-approval takes 48 hours.

Q2. What’s the home loan interest rate in Dubai today?

Averages 4.5-5.5% fixed. Varies by lender and profile.

Q3. Can I get mortgage loans for expats in Dubai?

Yes, up to 75% LTV with 10K+ salary. Sharia options available.

Q4. What’s minimum salary for home loan in UAE?

AED 10,000 for residents; higher for non-residents.

Q5. How does mortgage financing work for off-plan properties?

Banks finance up to 80%, staged payments. See invest in off-plan Dubai.

About The Author